Does college pay off? FREOPP’s latest analysis says… it depends

IMPORTANT UPDATE: Starting in July, I will transition this newsletter over to my personal Substack page. If you want to continue receiving updates from me, make sure you’re subscribed here.

These days, fewer Americans have confidence that a college degree will be worth the cost. While higher education’s boosters insist that the benefits of college outweigh the expense, young people look askance at high student debt burdens. Is college worth it or not?

My latest report for the Foundation for Research on Equal Opportunity argues that the framing of the question is wrong. “College” is not one thing, but rather many different programs and pathways. Depending on their choices, students get a lot of value from college, or none at all. Making responsible choices about college starts with having good data on the financial value of the various pathways available.

Measuring the value of college: return on investment (ROI)

The new report presents estimates of return on investment (ROI) for over 53,000 degree and certificate programs, ranging from trade schools to medical schools and everything in between. I define ROI as the increase in lifetime earnings that a student can expect from a particular college degree, after subtracting the cost of college and (critically) adjusting for the risk that she will not finish on time.

If ROI is positive, then students who enroll in that degree program can expect to gain financially. If ROI is negative, then the program is unlikely to fully compensate students for the cost and risk of pursuing higher education.

Overall, 69 percent of degree and certificate programs with available data have positive ROI, meaning they usually leave students better off. Bachelor’s degrees are usually a good bet, with 77 percent having positive ROI, though there are exceptions. Two-year degrees and master’s degrees are the riskiest sorts of programs—almost half of these degrees leave students worse off.

Perhaps the most important factor associated with ROI is field of study. Among bachelor’s degree programs, typical ROI is above $500,000 for engineering, computer science, nursing, and economics programs. Other majors including political science, business, and mathematics have a decent return as well. But ROI is typically below $100,000 for majors such as psychology, English, education, and fine arts—and a significant share of these degrees have no return at all.

What if you don’t want to get a bachelor’s degree? Fortunately, there are still some good options. A vocational certificate in the technical trades—including HVAC technology, auto repair, welding, and other fields—has a higher ROI than the median bachelor’s degree. Another good option is a two-year degree in registered nursing. But field of study matters a lot below the bachelor’s degree level: a two-year degree in liberal arts or a certificate in cosmetology usually leaves students worse off.

Introducing FREOPP’s ROI dashboard

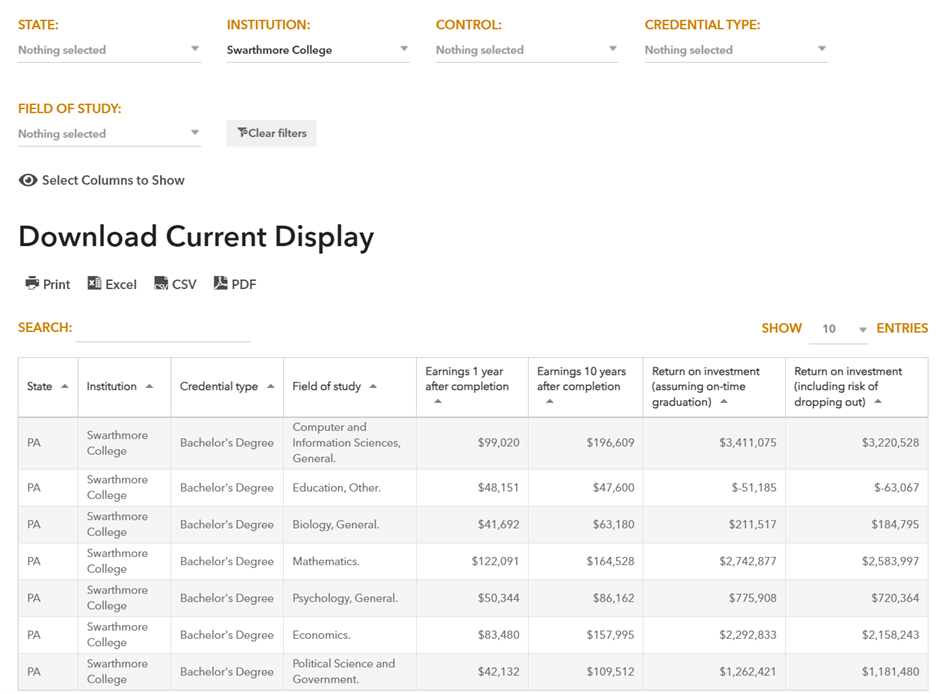

If you want to dive deeper into the data, FREOPP has also published a brand-new dashboard where you can look up data for your own degree. Simply select your institution from the dropdown list at the top, and the dashboard will automatically display our ROI estimates for the credentials offered there. You can also filter the data by state, institution control, credential type, and field of study.

We calculate ROI in multiple ways: one measure assumes you complete on time, and another accounts for the risk of dropping out. You can also see our estimates of median earnings during the early career and mid-career.

Here’s what the dashboard looks like for my own alma mater, Swarthmore College.

Over the coming weeks, I’ll publish some more analyses of the ROI database at FREOPP.org and various other places. For now, if you’d like to dig deeper, check out the full report.

What I’m writing

- Nothing predicts college completion like high school GPA. (OppBlog) Speaking of ROI, one of the most important reasons students frequently fail to see a return from college is non-completion. Starting college but not finishing often leaves students with debt they can’t repay. So what causes non-completion? Academic preparation is arguably the most important factor. Among students with an “A” average in high school, nearly 90 percent of those who start college finish within eight years. But among students with a “C” average, the completion rate is just 33 percent.

- Biden’s latest student loan cancellation plan doesn’t fix the underlying problem. (Forbes) The Education Department is out with a brand-new student loan cancellation plan, this one for a relatively modest price tag of $147 billion. (Yes, “relatively” is doing a lot of work there.) One of its principal components: canceling accrued interest for borrowers who owe more now than they did upon entering repayment. About 25 million people fall into this category. I argue that the student loan system offers far too many opportunities to avoid paying down principal on your loans. It’s a direct result of misguided government policy that hands out loans with few safeguards, then creates plenty of options to avoid paying.

- The federal student loan program is unraveling. (CNN Opinion) Both parties seem to agree that the federal student loan program is broken, though there’s disagreement over what to do about it. Democrats want to forgive past debts, while Republicans want to get the government out of the student loan business entirely. Beth Akers, Joe Pitts and I argue it’s time to take the latter argument seriously. Privatizing student loans would curb the worst excesses of government meddling in higher education and save taxpayers a bundle—but there are serious pitfalls privatization advocates need to wrestle with.

What I’m reading

- Grade inflation is rampant in higher ed, but colleges aren’t talking about it, write a group of scholars for the Chronicle of Higher Education. Thanks to higher GPAs, college completion rates are on the upswing. But that’s not because students are learning more: “students with the same demonstrated proficiency got higher GPAs as time went on,” the authors conclude based on new research.

- The chaos around the new FAFSA form continues, and it’s wrecking some students’ lives, write Alia Wong and Zach Schermele at USA Today. Their profiles of students affected by the disastrous FAFSA rollout include students who have missed out on scholarship aid or taken extra jobs to cover cost. Some are skipping college altogether.

- A new law in Colorado aims to improve transfer of credit between institutions, writes Jessica Blake at Inside Higher Ed. Students typically lose almost half their credits when they transfer between colleges, and sometimes they can’t apply most of their old credits to their new major. The bill standardizes credit transfer pathways for popular majors and requires schools to disclose how many transfer credits they reject.

- The Biden administration wants to ban colleges from packaging textbooks with the cost of tuition, writes Alex Tabarrok at Marginal Revolution. The campaign against such “Inclusive Access” programs—which the Obama administration promoted in the past—seems to be at odds with the Biden administration’s war on “junk fees.”

- When are anti-Israel campus protests protected free expression, and when do they cross a line? Greg Lukianoff of the Foundation for Individual Rights and Expression has a great compendium of recent anti-Israel campus protests and schools’ reactions. College presidents have done a poor job both protecting free speech and punishing clear violations of campus rules.

What I’m doing

Check out my conversation on CSPAN Washington Journal with Jared Bass of the Center for American Progress. We discuss/debate the Biden administration’s latest student loan cancellation plans.

No recent travel photos to share, so I’ll just reminisce about my trip this time last year to my aunt’s bison ranch in Illinois. I took this photo right after I told this bison the ROI of her master’s degree.

One more reminder to subscribe here if you want to keep receiving the Tassel in July and beyond.

FREOPP’s work is made possible by people like you, who share our belief that equal opportunity is central to the American Dream. Please join them by making a donation today.

">

">