Executive Summary

Inflation is one of the most widely discussed subjects in economic policy, especially at a time when common measures of inflation, like the Consumer Price Index for All Urban Consumers (CPI-U), are at 40-year highs.

Despite these facts, however, there are many important aspects of inflation that are either misunderstood or ignored, especially when it comes to how inflation affects lower-income Americans:

- Low-income Americans generally experience higher inflation rates than high-income Americans. Inflation indices like CPI-U attempt to measure price inflation for the average consumer. But most people are not average, and therefore, a single consumption “basket” does not reflect the way most Americans experience inflation. In particular, lower-income Americans have generally experienced higher inflation rates because housing represents a higher proportion of their spending, on average.

- Even modest inflation, compounded over time, disproportionately harms low earners. Most economists regard the period from 1982 to 2020 as a period in which the Federal Reserve managed inflation well, by keeping it stable and low. But because lower earners’ consumption baskets lead to slightly higher inflation rates, over time, the compounded effect of these higher rates is significant. From 1978 to 2021, the compounded effect of inflation was 43 percentage points higher for the lowest income decile vs. the highest.

- When adjusted for purchasing power, the impact of inflation on low earners is even worse. If the annual price of groceries for a family of four rises from $3,000 to $4,000, a wealthy family is far more able to absorb the extra $1,000 in costs than the working poor. If we examine the absolute impact of inflation, we find that from 2004 to 2020, earners in the bottom decile experienced inflation that was 71 percentage points higher than for the top decile, on a compounded basis.

These results mean that, even in an era of “modest” inflation, low earners need to experience faster wage growth than high earners do in order to keep pace. In general, the reverse has happened: high earners’ incomes have grown much faster than those of low earners.

Our findings indicate that much more research should be done on the distributional effects of even modest long-term inflation. In particular, our work suggests that the Federal Reserve’s average inflation target of 2 percent may be too high.

Introducing FREOPP’s Inflation Inequality Indices (FREOPP 3i)

Politicians and advocates often claim that expansionary monetary policy tends to help lower-income households more than their high-income counterparts. But when we consider the inflationary effect of expansionary policy in tandem with the more volatile incomes and employment statuses of low earners, the purported benefits of monetary expansion seem less clear.

In January 2022, Federal Reserve Chair Jay Powell observed that “we control inflation for the benefit of all Americans, but…it’s particularly hard on people with fixed incomes and low incomes who spend most of their income on necessities which are experiencing high inflation now.”

In this paper, we have quantified the phenomenon that Powell describes. Particularly, we seek to identify the degree to which the low-income households differ from upper-income households in the way they experience inflation. To get a better understanding of the issue, we consider several questions:

- To what extent does inflation inequality exist and persist?

- Quantitatively, how big of a difference is there in inflation adjusted for purchasing power for low versus high-income households?

- What is a good real-time approximation of the welfare effect of inflation across the income distribution?

The answers to these questions have serious policy implications. We hope to prod researchers to confront these challenges with our Inflation Inequality Indices (FREOPP 3i).

Despite the growing awareness that inflation is a serious problem, and that it may indeed impact the poor differently from others, policymakers, journalists, and the public lack a reliable and useful resource to measure and compare inflation harms across income groups. As Austan Goolsbee, former chair of President Obama’s Council of Economic Advisers, has argued, “For all the talk about income inequality, we need a matching discussion about inflation inequality.”

This is exactly the gap in the inflation policy conversation that we seek to fill especially as the Federal Reserve confronts the current issue of how to balance rival concerns that make up its dual mandate: price stability and maximum employment.

The Consumer Price Index for All Urban Consumers (CPI-U), the most referenced measure of inflation, is calculated in a simple way: by observing the price of a fixed basket of goods at multiple points in time and computing the difference. But this basket is calculated based on the consumption habits of the “average” consumer. In reality, as the chart below illustrates, the basket of goods consumed by lower-income people can differ from that of higher-income people.

For example, Americans in the bottom income quintile spend 43% of their income on housing and 14% on food, compared to 32% and 11%, respectively, for the highest quintile.

It is therefore straightforward to adjust the calculation of CPI using the appropriate basket by income group. Using price data from the Bureau of Labor Statistics and consumption weights from the Consumer Expenditure Survey, we can readily compute income-adjusted inflation, and therefore inflation inequality, at monthly and annual frequencies. (See the appendix for a more detailed discussion of our methodology.)

For ease of presentation, we mostly present annual data below. In particular, we show cumulative inflation inequality, cumulative purchasing power-adjusted inflation, and income-adjusted “misery indices” combining inflation and unemployment rates. Going forward, we plan on regularly updating the FREOPP Inflation Inequality Indices.

Inflation is cumulatively higher and more volatile for the poor

It is not widely appreciated that lower income households tend to face higher inflation volatility; that is, the goods that make up a large share of the poor’s consumption basket tend to have relatively more volatile prices. Indeed, necessities like energy, food, and gasoline — all of which are highly volatile — comprise a much larger fraction of consumption among low earners. Although these differences can be attributed to a few key factors, the difference is by no means irrelevant.

If we look first at monthly inflation data, we see that the most recent inflationary episode appears marginally sharper for higher income households. Below, we plot the annualized monthly inflation rate from January 2019 to March 2022 for the top and bottom deciles of the income distribution. Since the early 2021 surge, relative to the bottom decile, the top decile has actually experienced slightly more inflation and inflation volatility.

However, the most recent inflationary episode is a clear outlier in postwar history. In the figure below, we plot CPI-U inflation by income percentile from 1978 to 2021 using income thresholds from the Current Population Survey produced by the U.S. Census Bureau.

During the late 1970s and early 1980s when inflation was quite high, the poor tended to bear the most and greatest ill effects. When inflation falls sharply, as it did during the Great Recession, the poor again are most exposed to price volatility. A clear takeaway is that while the poor do experience greater volatility in the total price of the basket of goods they typically consume, and therefore tend to experience higher inflation, the magnitude of the difference on a percentage basis in a given year is small.

But looking solely at annual percentages fails to tell the complete story: small differences over short periods add up quickly into large differences over longer timespans.

In the figure below, we plot the price level for the top and bottom income deciles over time. Since 1978, prices have risen about 320% for the consumption basket of bottom income decile, compared to approximately 275% for the top decile.

There two key caveats to the above analysis.

First, people move in and out of different income categories constantly, so the static picture is not necessarily representative of a typical household in either category.

Second, consumers in the 1980s and 1990s endured significantly more price volatility than in the 2000s. We can roughly correct for both issues by considering a cutoff from the year 2000 as in the figure below. Since 2000, households from the bottom decile have seen their prices rise 64 percent, compared to only 53 percent for those in the top income decile. Again, this does not fully correct for either issue, but it does open a path to further discussion.

The persistence of the price-level difference and the apparent widening of the gap over the last two decades leads us to more seriously investigate the welfare consequences of inflation and monetary policy for households with different income levels.

Adjusting inflation for low earners’ lack of purchasing power

Before considering our preliminary evidence on welfare consequences of inflation, we take a step back and think about when inflation does and does not matter.

For example, in a condition that economists call “monetary neutrality,” the quantity of money changes in such a way that does not truly affect the purchasing power of individuals, nor unemployment rates, nor inflation-adjusted GDP. For example, if inflation rises by 3%, but wages also rise by 3%, and unemployment and real GDP are unchanged, money may be considered neutral. In such conditions, households and firms can flexibly adjust their behavior in response to inflation, and changes in the price level have no material impact on real wages and real output.

Evidence indicates that changes in the money supply are not neutral, especially over shorter timespans. Non-neutral monetary conditions can lead to quantitatively important consequences for real variables like unemployment and real GDP.

Many economists believe that inflation tends to not matter very much when it is expected, which is part of the rationale for a nominal output price-level (NGDP) target advocated by economists like David Beckworth and Scott Sumner. If households and firms believe the central bank can commit to a price-level-based inflation target, then people will rationally respond as if money is essentially neutral, whether it is or not in practice. Hence, when thinking about why inflation is bad, economists often discuss issues related to inflation volatility: firms consider additional uncertainty when setting prices and interactions between the tax system and inflation can exacerbate distortions. When unexpected, inflation can cause redistribution from creditors to debtors. These costs, and more, can arise from inflation.

A separate issue is seignorage. Inflation redistributes purchasing power from private agents to the government. The quantitative impact of this tends to be quite small in Western economies, particularly when inflation is low. Consequently, economists and policymakers tend to brush this redistribution aside as practically irrelevant. With our new tools at FREOPP, we want to change the conversation around inflation inequality, particularly as inflation becomes more volatile.

As many empirical studies have shown (see Parker et al. 2013), poorer people tend to have a higher average and marginal propensity to consume than their richer counterparts, as a share of their income. A family of four making $30,000 a year spends roughly the same $5,000 on groceries as does a family of four making $80,000 a year. Indeed, before taxes, many of the poorest households spend slightly more than they earn. Hence, even if inflation were constant across the income distribution — which, as we have shown above, it is not — low earners see a disproportionate decline in their purchasing power.

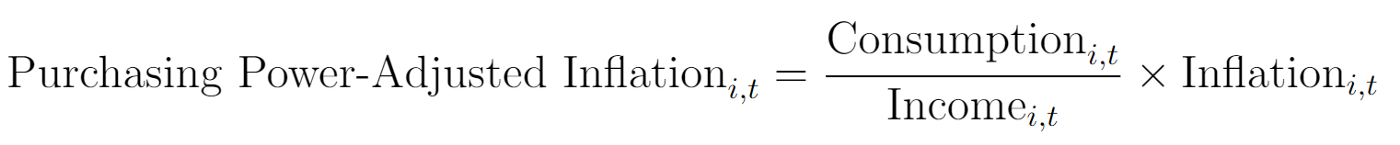

To measure this effect, we carried out the following exercise: After sorting households into their respective income deciles, we multiplied the fraction of income they consume by their decile-specific inflation rate. We call this “purchasing power-adjusted inflation.”

Purchasing power-adjusted inflation formula. Take consumption and income within each decile i at time t, then divide consumption by income and multiplying by the decile-specific inflation rate.

In the figure below, we illustrate purchasing power-adjusted inflation by income decile over the period 2004–20.

The implication is straightforward: The lower a household’s income, the more it will be impacted by inflation. With stable prices, there would be no difference across income groups. But with even mildly positive inflation, as we have experienced from 1982 to 2020, the impact of inflation is asymmetric. From the data, it is evident that there is nearly a proportional relationship between household income category and purchasing power-adjusted inflation. That is, on average, as households increase their income, they are more sheltered from the purchasing power-adjusted effects of inflation.

Wealthier households will tend to hold more of their savings in assets which appreciate during inflationary periods. Poorer households, by contrast, when they are able to save, will tend to put a greater proportion of their savings into low-return vehicles like saving and checking accounts. Over time, these differences accumulate into much larger effects.

With the caveat that we have not corrected for households moving between income categories, we show how much each income decile lost in cumulative purchasing power from 2004–2020 in the figure below. In sum, the top decile experienced a cumulative inflation rate of about nine percent over that time period, whereas the bottom decile experienced cumulative inflation of 76 percent. Even without correcting for the idiosyncrasies of each decile, the second decile still experienced 35 percent cumulative inflation, adjusted for purchasing power. This problem is only exacerbated by the inflation resulting from fiscal and monetary mismanagement in the aftermath of COVID-19.

Income growth vs. price growth

Many economists prefer not to look at growth in consumer prices on their own, but rather in tandem with growth in income. In practice, this is difficult, because a household’s relative income can change over time, from one decile or percentile to another. However, if we assume a household remains in a particular decile over time, we find disparities in both consumer prices and wage growth by decile.

As the above chart illustrates, a household in the bottom income decile in 1978, who remains there through 2021, has experienced a total cumulative inflation-adjusted growth in income of 4% over that timeframe. Meanwhile, a household in the top income decile has experienced cumulative growth of 81%.

Inflation and unemployment: The misery index revisited

In the 1970s, Yale economist Arthur Okun popularized the “misery index,” which is typically calculated by adding the unemployment rate to the inflation rate. Rather than give a precise estimate of economic welfare, Okun’s misery index intended to serve as mental shortcut for thinking about the state of the economy. Since then, economists have computed different misery indices, but the general idea remains the same. To that end, using inflation and unemployment microdata, we have built income decile-specific misery indices.

Much like inflation, unemployment disproportionately affects the poor. This stems from a number of factors, including the type of jobs poor people typically hold, and environmental factors. Without speculating further, note that these disparities show up quite clearly in the data. Using the Current Population Survey (see notes on data construction below), we constructed measures of unemployment based on household income, correcting as much as we can on a first pass for the fact that, mechanically, unemployed people have less income than working people (see appendix for further details).

One percent of inflation also is not always valued the same as one percent of unemployment. The authors of a 2001 paper found when conducting surveys of how unemployment and inflation affected people’s happiness, they found that “people would trade off a one-percentage-point increase in the employment rate for a 1.7-percentage-point increase in the inflation rate.”

The most basic misery index is simply a replication of Okun’s — adding the annual unemployment and inflation rates. We show this for the period 1989–2021 in the figure above, and for 2004–20 in the figure below. The spread between income deciles indicates substantial heterogeneity. Even setting aside the bottom decile, there is a large spread between the second decile on the one hand, which hovers around 15%, and the ninth and tenth deciles, which are close to 5% and approach zero at times.

In the next figure, we present a purchasing-power-adjusted misery index, which we call the FREOPP Misery Index. The calculation is straightforward: Simply add the purchasing power-adjusted inflation rate by decile as described above to the decile-specific unemployment rate.

Meaningful differences emerge, especially at the bottom decile. In 2011, Okun’s traditional misery index peaks at 27.9% for that cohort, whereas it peaks at 30.4% in the FREOPP misery index: a difference of +2.5%. In the top income decile, by contrast, the Okun misery index in 2011 was 6.5%, vs. 4.7% for the FREOPP misery index: a difference of -1.8%.

These results follow directly from the observation that lower income households tend to consume much more of their income than their high income counterparts.

We believe the FREOPP Misery Index presents a clearer picture of welfare than Okun’s because inflation matters substantially less to higher income groups than it does to lower income groups precisely because so much more of the poor’s purchasing power is lost.

The effect of inflation on assets and liabilities

It remains for us to discuss one more critical area of heterogeneity. Inflation has different effects on the assets and liabilities of individuals compared to their flow consumption.

As Doepke and Schneider show in a 2006 paper, unanticipated inflation reduces the nominal value of debts outstanding, something which helps borrowers and hurts lenders. The poor tend to borrow larger proportions of their net worth compared to the wealthy, but as the above figure shows, on an absolute level, the wealthy have much greater access to credit than do the poor.

Higher income households tend to own a disproportionate amount of stock compared to lower income households (see the figure below for details). There is evidence that the value of risky assets like stocks tend to increase in times of monetary easing, but the magnitude of the effect of inflation on assets and liabilities across income categories is unclear. We intend to conduct further research in this area.

The Fed should consider disparities in the compounded impact of inflation

The Federal Reserve Reform Act of 1977 instructed the Federal Reserve to “promote the goals of maximum employment, stable prices, and moderate long-term interest rates.” But outside of a few exceptions, notably Xavier Jaravel at the London School of Economics, policymakers and academics alike have largely ignored the distributional welfare consequences of inflation, especially as it compounds over time.

This is surprising, especially given that economists focus heavily on inequality in every other research domain. In particular, economists have extensively investigated disparities in wage growth across income levels, without taking into account the additional impact of how inflation affects income groups differently.

We hope that the Foundation For Research on Equal Opportunity’s Inflation Inequality Indices (FREOPP 3i) contribute to a richer discussion of the distributional consequences of inflation.

In August 2020, the Federal Reserve announced a major policy shift. Previously, it had established 2% as a ceiling for inflation rates. Now, the Fed seeks to keep the average inflation rate around 2%, meaning that it would permit inflation to exceed 2% at times, so long as the mid- to long-term average inflation rate remained 2%.

Our work suggests that the Fed should reconsider this shift. Given the compounding effect of even modest inflation on lower-income Americans, there may even be benefits to reducing the Fed’s inflation target below 2%. The Federal Reserve’s mandate should be understood as striving to achieve stable prices for all Americans — not merely the wealthy few.

Appendix

Please click here to review a folder with notes on data construction, including a data appendix, R code, and underlying files. We are grateful for excellent research assistance from Luke Kolar.