Wherever possible, states should remove degree requirements for government jobs, especially those that do not pay high salaries

Higher Education

Student debt now exceeds $1.5 trillion. We must overhaul a system that, for too long, has incentivized colleges and universities to charge unaffordable prices for degrees that do not always improve the lives of their recipients. Measures of return on investment (ROI) can help ensure that that institutions are accountable for the economic outcomes of the students they plunge into indebtedness.

All Higher Education

With mass cancellation potentially off the table, it is time for policymakers to think about better ways to fix federal student loans

This post is adapted from remarks I delivered at a recent roundtable hosted by the House Select Committee on Economic Disparity and Fairness in Growth

The only answer is to change the student loan program to limit new student lending and hold colleges accountable for poor labor-market outcomes

A better way is to stop requiring or encouraging aspiring public servants to take on so much debt

New research questions whether accreditors are up to the task of ensuring that students and taxpayers see a return on their investment

The Department of Education (ED) will give borrowers who were in delinquency or default prior to the payment pause a “fresh start” and allow them “to reenter repayment in good standing”

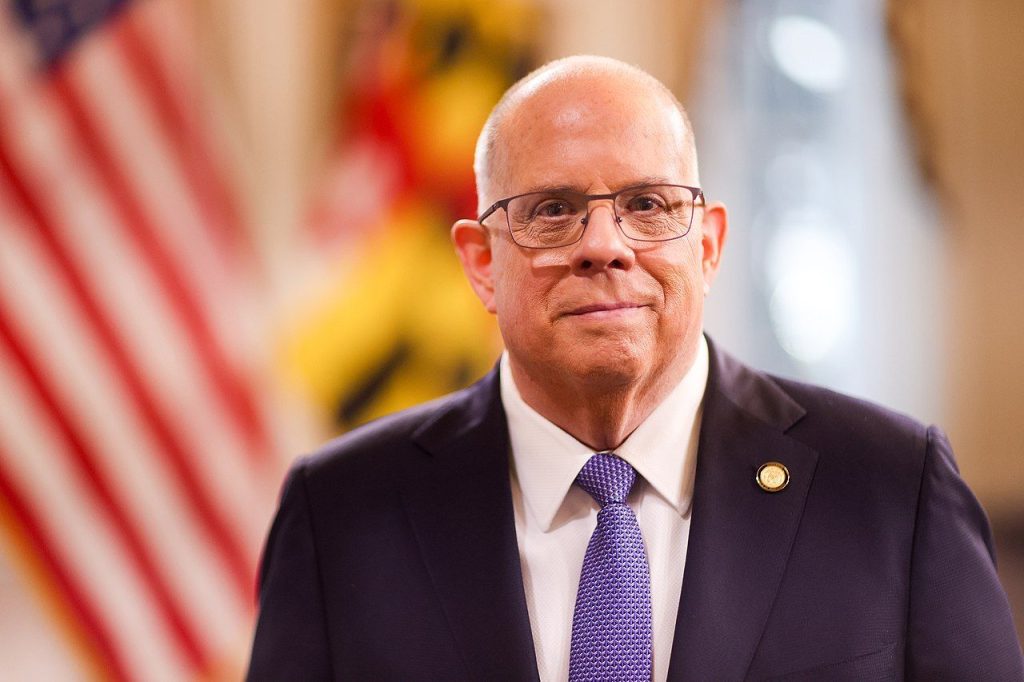

Governor Larry Hogan announced that he would eliminate the four-year degree requirement for thousands of jobs in the state government