Executive Summary

The high and growing price of prescription drugs is a pressing public policy problem. The Centers for Medicare and Medicaid Services project that U.S. prescription drug spending will increase by 84 percent over the next decade, the fastest rate of any major form of health expenditure.

High drug prices worsen the affordability of health insurance and care, and drive up the cost to taxpayers of financing public programs like Medicare and Medicaid.

Medicare Part B does not represent a “free market” for prescription drugs. Instead, the program uses government-administered reimbursement rates to pay for drugs. The structure of this system is far removed from how a true market would work.

As part of a comprehensive effort to enhance the affordability of prescription drugs, in October 2018, the Trump administration released a proposal to tie the way Medicare pays for physician-administered prescription drugs to prices paid by a group of other industrialized nations: Austria, Belgium, Canada, Czech Republic, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Japan, Portugal, Slovakia, Spain, Sweden, and the United Kingdom.

The proposal was criticized by many on the right, who felt that benchmarking Medicare’s payment rates to international rates was an implicit endorsement of government-run health care. However, the conservative critique rests on a number of misconceptions about the way Medicare and other countries pay for prescription drugs.

Not all advanced countries with universal coverage have single-payer health care systems. Nor do all advanced countries deploy price controls. As a result, not all foreign countries have access problems to new medicines. Indeed, many of the largest and most successful pharmaceutical companies in the world are based in Europe and Japan.

Furthermore, Medicare Part B does not represent a “free market” for prescription drugs. Instead, the program uses government-administered reimbursement rates to pay for drugs. The structure of this system is far removed from how a true market would work.

First, Medicare Part B is effectively required to pay for nearly all FDA-approved physician-administered drugs, regardless of their price or value. In any true market, the prospective buyer has the option not to buy: a feature that is essential to generating a true price signal. This is mostly absent from Medicare.

There are other distortions. Physicians receive a 6 percent commission on drugs used in Medicare Part B, incentivizing them to use the highest-price drug available, regardless of clinical value. And because it is considered bad clinical practice to switch patients off of drugs under which their diseases are well-controlled, patients with chronic diseases are vulnerable to dramatic price increases on older drugs that they use and cannot discontinue.

A market-based reform of Medicare Part B drug pricing should address these and other distortions. Benchmarking drug prices to an international index could serve as an improvement upon the current system, but the Trump administration’s proposed International Pricing Index selected 15 countries without regard for the way they pay for prescription drugs.

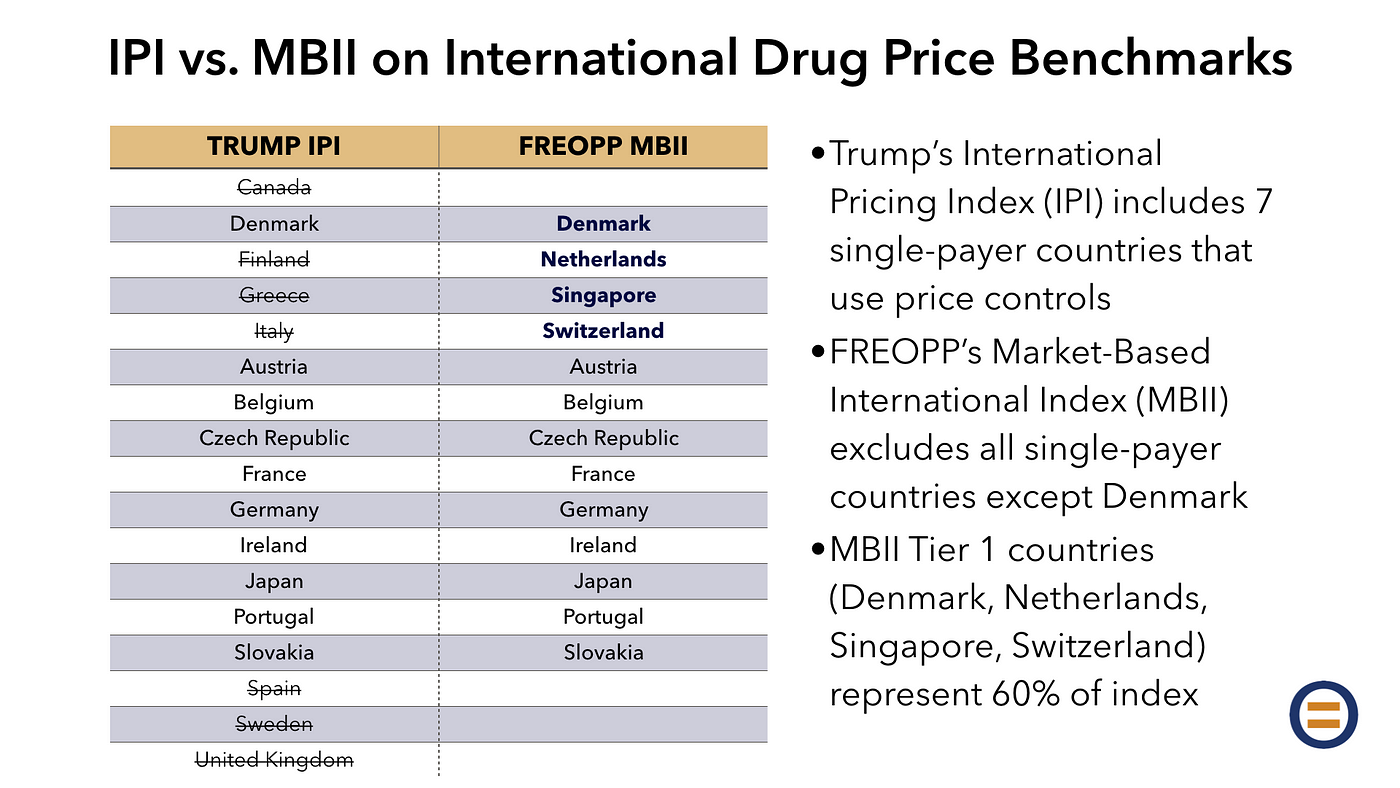

In this paper, we propose an alternative benchmark: the Market-Based International Index. The MBII excludes industrialized countries with little room for market-based pricing, due to an absence of private insurance and the presence of regulated drug prices. Included in the Trump administration’s International Pricing Index but excluded from the MBII are Canada, Finland, Greece, Italy, Spain, Sweden, and the United Kingdom.

Instead, the MBII includes countries in two tiers. Tier 1, representing 60 percent of the benchmark, includes the most market-oriented health care systems in the industrialized world — the Netherlands, Singapore, and Switzerland — and also Denmark, where prescription drug pricing is unregulated.

Tier 2, representing 40 percent of the benchmark, includes countries like the United States with a mix of private and public health insurance: Austria, Belgium, the Czech Republic, France, Germany, Ireland, Japan, Portugal, and Slovakia.

While we have not calculated the quantitative difference between prices in the IPI and the MBII, we believe that they will be similar. Indeed, it is possible that MBII-based prices would be lower. But the MBII would do a better job of aligning Medicare with countries that support pharmaceutical innovation, and could serve as an impetus for Medicare to learn from how other market-oriented countries improve the affordability of innovative medicines.

Most importantly, market-based reforms for the purchase of prescription drugs would actually make innovative medicines more affordable for those who most need them, and help make Medicare more fiscally sustainable for those who depend on it.

We believe that these reforms, combined with others described in our broad reform plan, Medicare Advantage for All, can make health insurance affordable for every American living today, while also enabling our health care system to be fiscally sustainable for the generations to come.

Introduction

The high and growing price of prescription drugs is a pressing public policy problem. The Centers for Medicare and Medicaid Services project that U.S. prescription drug spending will increase by 84 percent over the next decade, the fastest rate of any major form of health expenditure.

High drug prices worsen the affordability of health insurance and care, and drive up the cost to taxpayers of financing public programs like Medicare and Medicaid.

As part of a comprehensive effort to enhance the affordability of prescription drugs, in October 2018, the Trump administration released a proposal to tie the way Medicare pays for physician-administered prescription drugs to prices paid by a group of other industrialized nations: Austria, Belgium, Canada, Czech Republic, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Japan, Portugal, Slovakia, Spain, Sweden, and the United Kingdom.

Misconceptions about the International Price Index

The proposal was criticized by many on the right, who felt that benchmarking Medicare’s payment rates to international rates was an implicit endorsement of government-run health care. As the Wall Street Journal editorialized,

The reason European countries pay less for drugs is because they run single-payer health systems and dictate the prices they’re willing to pay. Don’t like it? They’ll then vitiate your patents and make a copycat. This is hardly a “voluntary” discount. Other countries have the luxury of extortion because the U.S. produces more drugs than the rest of the world combined. Mr. Trump mentioned these realities in his speech but blew past them to suggest importing the same bad behavior.

By the way, Europe does pay more — in the form of reduced access. Of 74 cancer drugs launched between 2011 and 2018, 70 (95%) are available in the United States. Compare that with 74% in the U.K., 49% in Japan, and 8% in Greece. This should cure anyone of the delusion that these countries will simply start to pay more for drugs. They’re willing to deny treatments if it saves money.

Drugs that are approved in foreign countries are often delayed in reaching patients — on average 17 months across 16 industrialized nations, by one analysis. Other countries have lengthy fights about how much the health system will pay, whereas in the U.S. drugs are available almost immediately after approval…

Mr. Trump is right that Europe, Australia and many others are freeloaders on U.S. innovation, and better intellectual property protections in trade deals might help. But that is no reason to repeat their price-control mistake and undermine the reasons the United States is the last, best hope for medical progress.

The conservative critique rests on a number of misconceptions about the way Medicare and other countries pay for prescription drugs.

- Not all advanced countries with universal coverage have single-payer health care systems. A single-payer health care system is defined as one in which the government is the sole major medical health insurer. Switzerland, Germany, and the Netherlands, by contrast, provide universal coverage through private insurance. A number of other countries, such as Singapore and France, have systems that, like America’s, represent a hybrid of public and private health insurance.

- Not all foreign countries have access problems to new medicines. As the above chart shows, a number of European countries — most notably Germany, Britain, Denmark, and Sweden — enjoy rapid and frequent access to innovative medicines, comparable to that of the United States. In Denmark, for example, after a drug is approved by the European Medicines Agency (the European equivalent of the FDA), it takes an average of five months for that drug to reach patients. This is, in large part, due to the use of free pricing in these high-access countries.

- Not all advanced countries deploy price controls. Most notably, Denmark and Singapore have not regulated drug prices. Germany has free pricing for the first year of launch, which has encouraged manufacturers to rapidly enter its large market, after which a negotiation takes place.

- Many of the largest and most successful pharmaceutical companies are foreign. While the U.S. leads the world in the development of innovative medicines, it is far from alone. Major non-U.S. pharmaceutical companies include AstraZeneca and GlaxoSmithKline of the United Kingdom, Roche and Novartis of Switzerland, Sanofi of France, Merck KGaA and Bayer of Germany, and Takeda, Astellas, and Daiichi Sankyo of Japan. The combined market capitalization of these companies is approximately $850 billion, and does not include the many smaller companies domiciled outside the U.S.

Medicare and Medicaid do not represent a ‘free market’ for prescription drugs

Contrary to popular understanding, the U.S. does not have a “free market” for prescription drug prices in its major public health insurance programs. Fundamental to a free market, and to a true price signal, is the ability to walk away: to decide not to purchase a product. Medicaid and Medicare reflect the opposite principle.

The Medicaid program, by law, is required to pay for nearly all FDA-approved drugs, regardless of their price or value. Similarly, the Medicare Part B program is required to pay for all FDA-approved, physician-administered drugs. In Medicare Part D, the most market-oriented of the large public programs, prescription drug plans do have some ability to exclude high-cost or low-value drugs from their formularies; however, plans are unable to walk away from drugs in six “protected classes”: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretroviral drugs (such as those used to treat HIV), and anti-cancer drugs. Only the Veterans Health Administration and the Department of Defense have the latitude to leave drugs off their formularies entirely.

Further, public programs in the U.S. already use European-style techniques to reduce prescription drug spending. Medicaid uses a “best price” technique to pay the lower of two prices: 23.1 percent lower than the average price paid by other payers, or the lowest price paid by other payers. The Veterans Health Administration and the Department of Defense directly negotiate prescription drug prices with manufacturers.

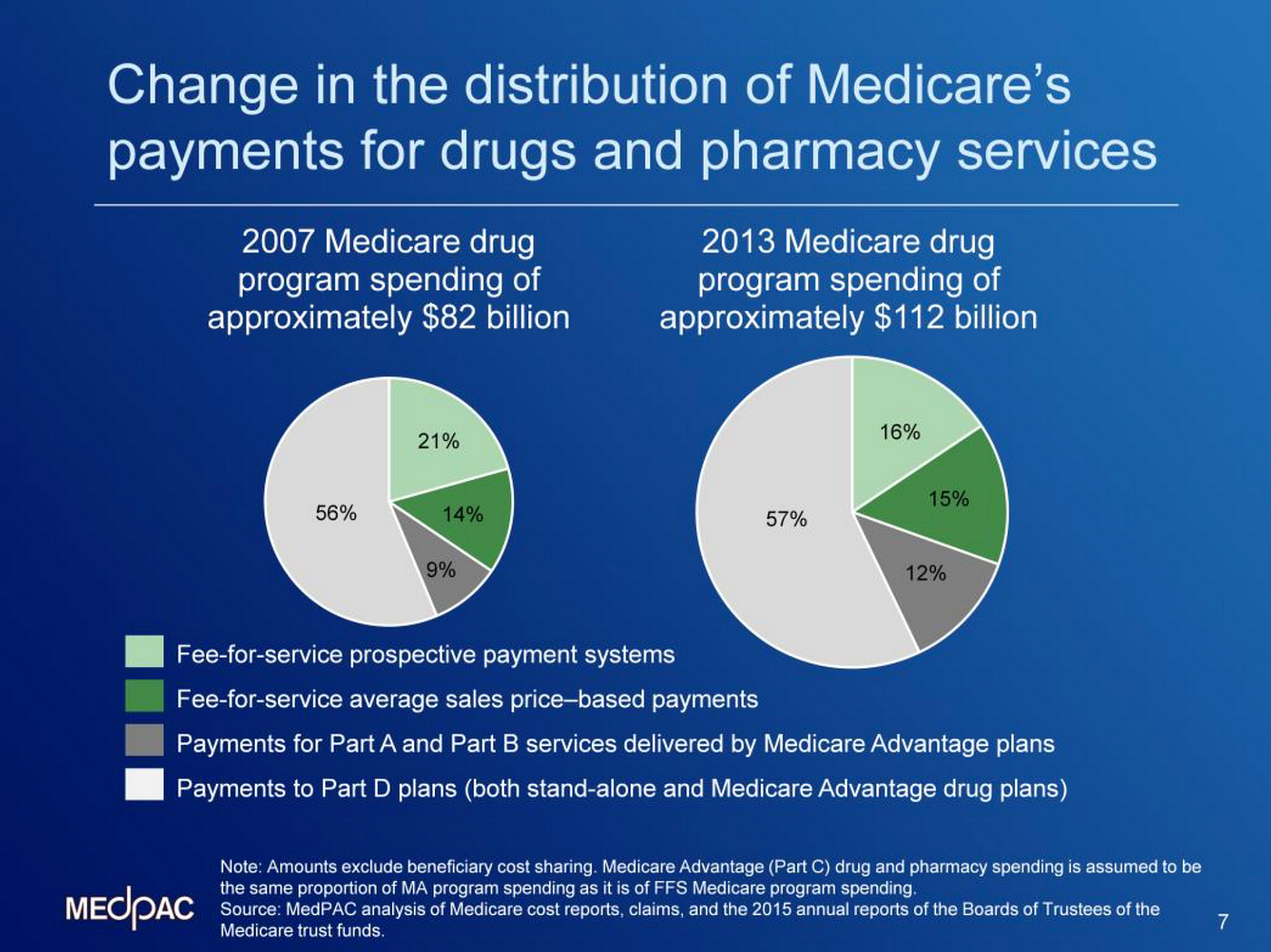

Medicare’s four different programs — Parts A, B, C, and D — price drugs in different ways:

- Part A pays hospitals and skilled nursing facilities prospectively for a given health care service in which drugs are used. Medicare reimburses providers for a given service (fee-for-service) at a government-determined rate which is based on the government’s expected cost of that service; hospitals and nursing facilities negotiate with drug manufacturers for the drugs they use, often using wholesalers and group purchasing organizations, and use the government’s reimbursements as a kind of “budget” for the services they provide. If providers do a good job of negotiating drug prices, they get to pocket the difference between Medicare’s rates and their own costs.

- Part B pays physicians for drugs administered in a doctor’s office, such as intravenously infused drugs and certain drugs requiring an injection. Today, Medicare reimburses doctors for most drugs they administer using a formula called “ASP+6.” (We will return to this concept in a bit.) New, single-source drugs are generally reimbursed at 106 percent of the wholesale acquisition cost (WAC).

- Part C funds privately-administered insurance plans that deliver the same benefits as Parts A and B combined: that is to say, care delivered by hospitals, skilled nursing facilities, and physicians. Medicare Part C plans can be designed in a number of ways, but generally speaking, they are required to cover the same drugs that Parts A and B are required to cover. Medicare pays participating insurers on a per-person (capitated) basis, based on benchmarks and insurer bids.

- Part D covers retail prescription drugs: that is to say, the kinds of drugs patients pick up from their local pharmacy, as opposed to those administered in a hospital or physician office setting. These drugs are not covered by the other parts of Medicare. Part D is the most market-oriented of Medicare’s programs. The program is entirely administered by private insurers, and seniors have a broad array of insurance options. Outside of the aforementioned “protected classes” — an important exception — Part D plans have the latitude to tier their formularies to incentivize enrollees to use lower-cost, higher value drugs: by, for example, requiring higher co-pays for costlier, lower-value drugs; or by leaving those high-cost drugs off of the formulary altogether.

The sordid history of regulated drug prices in Medicare Part B

Medicare Part B, since it was enacted in 1965, has always administered a government-regulated price for physician administered drugs, though the exact price formula has evolved over time.

Prior to 1997, payment for physician-administered drugs was based on either the estimated acquisition cost of a drug by a physician, or the national average wholesale price (AWP), whichever was lower. Medicare could also choose to reimburse physicians based on a “reasonable cost or prospective payment.” This system led to considerable abuse, as the official reimbursement rates set by Medicare were sometimes far higher than what physicians actually paid for a given drug. Physicians and physician groups could make substantial profits merely by arbitraging the difference between the government-set price and the actual acquisition price.

The Balanced Budget Act of 1997 undertook many reforms of the Medicare program, including a slight change to the way Part B paid for drugs. Medicare would now pay 95 percent of the average wholesale price for a given physician-administered drug, or the estimated acquisition cost, whichever was lower. While this change reduced some of the value of the price arbitrage, it did not eliminate it.

“The problem, at least in part, was that the AWP was a reported manufacturing price that was never defined in law or regulation,” recalled former Medicare administrator Gail Wilensky. “It was such an unreliable indicator of what was actually paid that it was commonly known in Washington as ‘ain’t what’s paid.’”

Faced with skyrocketing growth in Part B drug spending—exceeding 20 percent per year—Congress once again revised the Part B drug price formula in the Medicare Modernization Act of 2003. The revised formula, “ASP+6,” is the one still operating today for most drugs.

“ASP” stands for average selling price, and “6” stands for the 6 percent commission physicians receive on top of the average selling price for a given drug. (For new, single-source drugs where ASP data is unavailable, Medicare pays 106 percent of the wholesale acquisition cost, or WAC, which represents manufacturer’s list price before rebates or discounts.)

Medicare Part B’s average selling price formula—and thereby its reimbursement rates—are calculated by using a weighted average of what private insurers pay for a drug, inclusive of rebates and wholesaler discounts.

Under the ASP+6 formula, Medicare Part B drug spending has continued to rise, at several multiples of consumer inflation. The pharmaceutical industry argues that ASP+6 is a “market-based price,” but for several reasons, it is not:

- Mandatory coverage of nearly all FDA-approved drugs distorts price signals. As discussed above, Medicare Part B is required by law to pay for nearly all FDA-approved physician-administered drugs, regardless of their price or value. No true market can exist where buyers are forced to buy.

- 6% commission incentivizes physicians to prescribe higher-priced drugs, regardless of clinical benefit. Because of the 6 percent commission in the ASP+6 formula, doctors make more money if they administer higher-priced drugs. This leads to a distorted market in which physicians are actively incentivized to avoid administering low-cost, high-value medications.

- ASP+6 actively precludes price competition among drugs with similar clinical effects. As the Medicare Payment Advisory Commission noted in June 2017, “the current ASP payment system—with most single-source drugs and biologics each paid under separate billing codes—does not spur price competition among drugs with similar health effects.” Because physicians have no economic incentive to choose the cheaper drug, manufacturers have no incentive to reduce the prices of their products.

- Not all drugs are reimbursed at ASP+6. As discussed above, newer, single-source drugs are reimbursed at 106 percent of the manufacturer’s list price. Effectively, for these drugs, Medicare is forced to pay whatever manufacturers decide to charge.

- Prices for physician-administered drugs paid by private insurers are heavily distorted by federal policy. The pharmaceutical industry argues that because ASP+6 is calculated from prices paid by private insurers, ASP+6 represents a “market price.” This is not true, for several reasons. First, the vast majority of private health insurance is purchased by employers on behalf of their employees using pre-tax dollars, preventing patients from making value-based decisions about their health coverage, and eliminating pressure from insurers to drive harder bargains with manufacturers. Second, as the Health and Human Services Department notes, Medicare represents at least half the market for drugs representing about one-third of Medicare Part B spending, because those drugs are disproportionately used by the elderly. Because these drugs represent limited opportunities for cost savings for private insurers, private insurers rarely work hard to negotiate down their prices.

- The ASP formula fails to reflect market-based coverage decisions. Take two drugs, each of which is sold for $10,000 per month. The first drug is only covered by few insurers, representing 20 percent of the market, because the drug is of marginal benefit for patients at the $10,000 price. The second drug is covered by most insurers, representing 90 percent of the market, because the drug is of substantial benefit for patients at the $10,000 price. Under the ASP formula, Medicare is mandated to subsidize these two drugs equally for all Medicare Part B enrollees, and is forced to disregard this market signal, in which the second drug is a much better value than the first.

- Innovative drugs are granted legal monopolies through the patent system. While it is entirely justified to grant patents to innovative medicines, markets require competition, and monopolies restrict or eliminate competition, especially for diseases where there is only one FDA-approved drug.

- It is considered bad clinical practice to switch patients off of drugs under which their diseases are well-controlled. For example, if a multiple sclerosis patient is well-controlled on Avonex, it is considered bad clinical practice to put the patient at risk by switching her to a competing drug like Rebif, even if Rebif has a greater clinical or economic benefit. Manufacturers take advantage of this phenomenon to dramatically increase the prices of their older drugs, year over year. New research from the University of Pittsburgh and Harvard finds that between 2008 and 2016, the costs of injectable, on-patent drugs increased 15 percent per year on average; the increases were entirely driven by existing drugs as opposed to newly-launched drugs. “In the brand-name market, there was inflation of drugs that have been around for a while,” co-author Inmaculada Hernandez told Dylan Scott of Vox.

What an ideal Medicare prescription drug market would look like

It is impossible to eliminate all market distortions from public health care programs; the mere existence of subsidies decreases the price sensitivity of consumers, and the fact that prices are further clouded behind the veil of third-party payment means that Medicare enrollees lack the necessary tools and incentives to drive prescription drug value on their own.

In addition, there will always be a need for a regulatory agency like the FDA to certify the safety and efficacy of new drugs, and there will always be a patent system to secure legal monopolies for innovative products.

There are, however, several principles of reform that we can consider so as to harness the power of markets to reduce costs and increase the value and quality of physician-administered drugs reimbursed by Medicare:

- Eliminate the mandate that Medicare pay for all drugs, regardless of quality, price, or value. Medicare Part B should be able to use the tools available to all private insurers: to design formularies with tiered co-pays, and to eliminate coverage of drugs whose prices cannot be justified relative to their clinical benefit.

- Allow seniors to choose among multiple plans that compete on price to deliver the Medicare Part B benefit. This is, in fact, what Medicare Parts C and D do; Part D, especially, facilitates vigorous price competition among private insurers to deliver prescription drug coverage. The downstream effect of this price competition is to force insurers to cover drugs in the most cost-effective way possible, including aggressive price negotiation. One way to advance this idea is to implement default enrollment in a zero-premium or negative-premium Part C plan for newly eligible Medicare enrollees; today, newly eligible seniors are enrolled in traditional Medicare—Part A—by default. Changing the default enrollment in this way would involve no extra cost for seniors, but could deliver significant savings for the Medicare program.

- Incentivize price competition for therapeutically similar drugs. Drugs that treat the same disease should compete with each other on price and clinical value. The ASP+6 formula prevents such competition, and should be replaced by one that incentivizes competition.

- Eliminate the ability of manufacturers to exploit the dependence of well-controlled patients on their drugs. As discussed above, patients with a chronic disease who are well-controlled with a specific medication have little ability to switch to a competing drug with a more favorable price or value. Manufacturers exploit this phenomenon by dramatically increasing prices, year over year, for older drugs. Medicare Part B’s reimbursement formula should only grow at consumer inflation for drugs that have been on the market for at least two years, disincentivizing physicians from prescribing drugs with exploitative pricing practices. Alternatively, MedPAC has proposed establishing an ASP inflation rebate, under which manufacturers would be required to repay the Medicare program for any price increases that exceed inflation.

- Eliminate price-based commissions to physicians. The ASP+6 formula should be replaced by a fixed fee for administering infused or injected drugs. The Trump-Azar proposal would enact such a reform, and also address the problem of physician inventory costs for such drugs by incentivizing the creating of private, third-party vendors: a reform that has also been proposed by the Medicare Payment Advisory Commission.

- Benchmark Medicare Part B’s reimbursement rates to those of countries where the above principles are applied. Absent direct reforms—liberalizing Medicare Part B’s formulary, migrating Part B drug coverage into Parts C and D, unifying reimbursement for therapeutically similar drugs, and capping price growth of existing drugs beyond consumer inflation—Medicare could benchmark its Part B reimbursement rates to those of other countries whose health care systems reflect these market-based principles. The Trump-Azar International Pricing Index would indeed benchmark Medicare Part B rates to a group of other industrialized nations, but countries in the benchmark were selected somewhat arbitrarily, as opposed to by their relationship to market-based practices. We will return to this subject below.

The Trump administration’s proposed International Pricing Index

In an October 2018 policy brief published by HHS’ Office of the Assistant Secretary for Planning and Evaluation (ASPE), the authors compared prices paid by Medicare Part B for physician-administered drugs to those paid in a set of other countries: Austria, Belgium, Canada, Czech Republic, Finland, France, Germany, Greece, Ireland, Italy, Japan, Portugal, Slovakia, Spain, Sweden, and the United Kingdom. ASPE explained that it chose those countries because they represented advanced economies whose drug price data was readily available via IQVIA, a company that compiles drug pricing data:

To ensure a broad representation of similar countries, we selected all countries in the G7 [Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States] and all countries in Germany’s external reference pricing market basket [currently Austria, Belgium, the Czech Republic, Denmark, Finland, France, Greece, Ireland, Italy, the Netherlands, Portugal, Sweden, Slovakia, Spain, and the United Kingdom]. We then excluded two countries (Denmark and the Netherlands) from this resultant list for lack of data in the IQVIA databases. This results in 17 countries including the U.S. to be included in our study.

ASPE found that, among 27 drugs reimbursed by Part B, on average Medicare paid 80 percent more than the price paid by this group of countries.

In response to these findings, the Trump administration has proposed piloting a replacement of Medicare Part B’s ASP+6 formula with a new formula, in which Medicare would target “about a 30 percent reduction in Medicare spending for included Part B drugs over time.” In effect, the change would reduce the price premium from 80 percent of the international peers to 26 percent.

HHS estimates that, over a five-year period, adoption of the International Pricing Index would reduce Medicare Part B drug spending by $17 billion, representing less than 1 percent of U.S. drug expenditures over that period. Savings could be greater in future years, because the IPI would be phased in gradually over the five-year period, and only for 50 percent of Medicare Part B enrollees. In future years, the pilot could be expanded to all enrollees, with lower prices fully phased in.

Flaws in the International Pricing Index

Given the limitations of the Trump administration to reform Medicare’s reimbursement policies without an act of Congress, there are three principal deficiencies with the International Pricing Index as described.

- Countries in the international benchmark were selected somewhat arbitrarily. The countries comprising the benchmark were chosen for the sole reason that pricing data for those countries were readily available through a third-party vendor, IQVIA. A more market-based benchmark would eliminate countries with price-controlled single-payer health care systems, and would emphasize countries with market-based systems. Notably, the three most market-based health care systems in the world—those of Singapore, Switzerland, and the Netherlands—were excluded from the International Pricing Index. Moving to a market-oriented index would not necessarily lead to higher drug prices; indeed, it could lead to a lower price benchmark.

- Moving from an average 80% premium to international prices to a 26% premium unnecessarily curtails the reform opportunity. The Trump administration is likely to have sought to reduce Medicare Part B drug prices by this amount for political reasons; i.e., to blunt criticism from industry. But industry is fighting the administration’s proposal with just as much vigor as it would have otherwise, and the administration has limited the taxpayer savings that could otherwise be achieved by moving more simply to a 0 percent premium to the international benchmark. Indeed, given the purchasing power of the United States, the U.S. would be within its rights to seek a meaningful discount to the international benchmark.

- The International Pricing Index benchmark prices may still outpace inflation. The administration’s proposal should eliminate the ability of manufacturers to exploit patients with chronic diseases, currently well controlled with an existing drug, who face clinical risks if they switch to a new medication.

Proposing a new Market-Based International Index

In order to address these limitations in the International Pricing Index (IPI), we are proposing a new index: the Market-Based International Index (MBII). The MBII addresses the principal flaws of the IPI by: (1) developing a new benchmark more heavily weighted towards market-based health care systems; (2) achieving greater savings by moving Medicare Part B reimbursement rates to a 0 percent premium to the MBII, as opposed to a 26 percent premium to the IPI; and (3) growing Medicare Part B reimbursement rates at either the benchmark price or last year’s price increased by consumer inflation, whichever is lower.

In order to determine the countries included in the Market-Based International Index, we assigned the 16 countries in the International Pricing Index, and eight others—the Netherlands, Singapore, Switzerland, Australia, New Zealand, Norway, South Korea, and Taiwan—into three tiers:

- Tier 1 (Denmark, the Netherlands, Singapore, Switzerland): Countries where prescription drug prices are largely or entirely unregulated, and/or where a competitive private health insurance market provides the vast majority of coverage. Prices in these countries will be overweighted, so as to comprise 60 percent of the Market-Based International Index’s benchmark prices.

- Tier 2 (Austria, Belgium, Czech Republic, France, Germany, Ireland, Japan, Portugal, Slovakia): Countries—like the United States—with a hybrid system of public and private health insurance and prescription drug price regulation. These countries will be underweighted, so as to comprise 40 percent of the MBII’s benchmark prices.

- Tier 3 (Australia, Canada, Finland, Greece, Italy, New Zealand, Norway, South Korea, Spain, Sweden, Taiwan, United Kingdom): Countries with government-run health care systems and drug price controls, with little to no role for private insurance or market-based pricing. These countries are excluded from the MBII.

While we have not yet calculated what prices the Market-Based International Index would yield relative to the International Pricing Index, we believe they would be lower, especially after taking into account the 0 percent premium to the MBII, versus the Trump administration’s proposed 26 precent premium to the IPI. In addition, by capping the growth of Medicare Part B prices at consumer inflation, the MBII eliminates the risk that the IPI would fail to arrest drug price inflation.

As the above chart shows, Denmark’s spending on prescription drugs is the lowest in Europe, at 0.7 percent of gross domestic product. The U.S. spends four times as much on drugs: 2.7 percent of GDP. Singapore, whose GDP per capita is equal to that of the United States on a nominal basis, and significantly higher on a purchasing power parity-adjusted basis, spends approximately 4 percent of GDP on health care overall, compared to 18 percent in the U.S.

Brief profiles of countries in the Market-Based International Index

To help explain the rationale for how we tiered countries in the MBII, here are summaries of the health care and prescription drug systems in the MBII’s twelve benchmark countries.

- Denmark (Tier 1): Denmark has a comprehensive, single-payer health insurance system, financed by general taxation and administered at the regional level through block grants. However, Denmark does not regulate prescription drug prices. Instead, the Danish insurance system reimburses for any drug at the lowest price offered by a market participant for a given active pharmaceutical substance. Price transparency is universal; pharmacy prices are posted every two weeks by the Danish Medicines Agency (Lægemiddelstyrelsen). This encourages use of generic drugs. Consumers are free to pay out-of-pocket to use a costlier drug. However, since pharmaceutical companies would lose market share if their prices were too high, they have an incentive to price their products competitively. The Danish Ministry of Social Affairs and Health also has the latitude to choose not to reimburse for drugs in therapeutic areas with a monopoly supplier, though consumers are free to pay for these drugs out-of-pocket.

- The Netherlands (Tier 1): Holland has a universal system centered around private health insurance coverage. Multiple private insurers compete for market share, on the basis of price and quality. Insurers are required to take all applicants and must adhere to a basic benefit package, but can offer additional benefits on top of the required ones. Prescription drug formularies are managed by the insurers under this competitive system. Coverage of some drugs is mandated by the Ministry of Health, which is advised on coverage decisions by the Netherlands Healthcare Institute (Zorginstituut Nederland). While drug prices float based on insurer-manufacturer negotiations, and insurers can increase or decrease deductibles for drugs based on their value, the government protects against monopoly drug pricing by setting price ceilings. Like Denmark and the U.S., generic drugs enjoy high market share in the Netherlands.

- Singapore (Tier 1): Singapore has a universal, consumer-driven health care system in which catastrophic coverage is covered by a single-payer, MediShield. However, non-catastrophic health care is paid for privately, using a universal system of health savings accounts (MediSave). Prescription drug pricing is unregulated. Drugs on a standard list maintained by the Ministry of Health are subsidized; drugs off the list are unsubsidized and obtainable via out-of-pocket spending.

- Switzerland (Tier 1): Switzerland has a universal market-based health insurance system, in which every Swiss citizen purchases private coverage on the individual market. The insurance benefit package is standardized to some degree by the Federal Office of Public Health, though individual regions (cantons) have considerable flexibility in how their insurance markets are structured. The Federal Drug Commission advises the FOPH on the inclusion of prescription drugs in the standard insurance benefits package; the FOPH regulates the reimbursement rates in this setting. In addition, insurers in a given canton can band together to jointly negotiate drug prices with a manufacturer. Switzerland is home to Roche and Novartis, two of the world’s largest pharmaceutical companies. Most other drug companies base their European headquarters in Switzerland due to the confederation’s low tax rates.

- Austria (Tier 2): Austria, like many countries in central Europe, has a hybrid public-private health care system based on “Bismarckian” principles, so called because Germany was the first country in the world to establish universal health insurance (in the 1880s). The Austro-Hungarian empire and its derivative nations soon followed. Today, health care in Austria is governed both at the federal level and at the state (Länder) level. Austria has 18 sickness funds, including at least one in each Länder. Maximum drug prices are capped by the federal government, but direct negotiation of drug prices is done by the health insurers’ trade association, the Main Association of Austrian Social Security Institutions (Hauptverband der österreichischen Sozialversicherungsträger, or HVB). For drugs that are not reimbursed by insurance, pricing is unregulated until a specific drug exceeds €750,000 in revenue in Austria. The utilization of generic drugs is low in Austria, because pharmacies are not allowed to substitute generic drugs for branded ones if the doctor prescribes the branded version.

- Belgium (Tier 2): Belgium, like Austria, has a hybrid Bismarckian system first established in the 19th century. Belgians are required to obtain health insurance from one of seven main national associations of sickness funds, six of which are private non-profits. The health care provider system is mostly private. Prescription drug reimbursements are negotiated by the Commission for the Reimbursement of Pharmaceuticals, with the final decisions made by the Belgian Minister of Social Affairs. The Belgian government also sets an annual global budget for public pharmaceutical expenditures, and requires drug companies to reimburse the government for spending in excess of that budget.

- Czech Republic (Tier 2): The Czech Republic also has a Bismarckian sickness funds system, originating in its membership in the Austro-Hungarian Empire prior to World War I. After a wave of consolidation, today there are seven private, self-governing sickness funds, the largest being the General Health Insurance Fund (Všeobecná zdravotní pojišťovna České republiky, or VZP). Universal coverage is financed through payroll contributions. The State Institute for Drug Control (Státní ústav pro kontrolu léčiv, or SÚKL) regulates drug prices by setting the maximum end-customer price at the level of the average of the three lowest prices in the European Union.

- France (Tier 2): France has a hybrid public-private system, but with a more centralized character than that of the other countries in Tier 2. France has a single-payer system for basic health insurance, but benefits are narrower than those in classic single-payer countries like Canada and the United Kingdom. As a result, more than 90 percent of the population purchases lightly regulated supplemental private coverage, similar to Medigap plans in the United States. This market-based feature lifts France from Tier 3 to Tier 2. Drug prices are negotiated by a government agency, the Economic Committee for Health Products (Comité Économique des Produits de Santé, or CEPS); however, generic medicines have fairly low market share in France, which allows pharmaceutical companies to generate considerable revenues from drugs whose patents have expired.

- Germany (Tier 2): As noted above, Germany’s universal health care system was established by Otto von Bismarck in the 1880s. Germans usually obtain health insurance through their employers. Insurance is offered by one of over a thousand public or private “sickness funds.” Civil servants, students, and those with annual incomes above €60,000 have the broadest insurance choices; the rest must enroll in a government-approved private or public sickness fund. Germany has unregulated drug launch pricing: a feature that has allowed drugs to reach the market quickly in Germany. After a drug has been on the market for one year, the national price is negotiated between the manufacturer and the National Association of Statutory Health Insurance Funds (GKV-Spitzenverband), balancing the monopoly power of the drug manufacturer with that of the insurer association. Generic drugs have high market share in Germany, due to the use of internal reference pricing.

- Ireland (Tier 2): More than half of the Irish population has private health insurance, a comparable proportion to the United States. However, competition among private insurers is relatively low. The largest private insurer, the Voluntary Health Insurance Board, once had an effective private insurance monopoly, until the European Union forced Ireland to liberalize its insurance market. Today, VHI has 75 percent market share, with two other insurers taking nearly all of the rest. Drug prices are regulated in Ireland, by benchmarking Irish prices to those of the U.K., Denmark, France, Germany, and the Netherlands. Due to Ireland’s highly favorable corporate tax code, many U.S. pharmaceutical companies — including Johnson & Johnson, Pfizer, Merck, Amgen, AbbVie, Gilead, and Bristol-Myers Squibb — have significant operations in Ireland.

- Japan (Tier 2): At the behest of the occupying American army, Japan established a universal coverage system after World War II. The Japanese system is Bismarckian in structure, with over 3,000 health insurers: some public, some private. The Japanese government sets the price for all drugs reimbursed by health insurers; non-covered drugs have free pricing. Japan has a robust domestic pharmaceutical industry, led by Takeda, Daiichi Sankyo, and many others.

- Portugal (Tier 2): Portugal has a hybrid public-private health insurance system. A majority are enrolled in public insurance through the Portuguese National Health Service, but a quarter are enrolled in private insurance, either through a professional association or the individual market. Private insurers in Portugal enjoy more regulatory freedom than do American insurers in terms of benefit design. The Portuguese NHS directly negotiates drug prices for its enrollees, and also uses external reference pricing (benchmarking Portuguese prices to those of other countries) as a tool.

- Slovakia (Tier 2): Slovakia’s health insurance system is similar to that of Switzerland’s. Every Slovakian is enrolled in private health insurance, the costs of which are largely funded through payroll taxes. Slovakians have freedom to choose their insurance plan; however, after a wave of consolidation, there are three main health insurers in Slovakia: General HIC, Dôvera, and Union. General HIC, which has roughly two-thirds market share, is state-owned, which is why Slovakia is in Tier 2 and not Tier 1 like Switzerland. The government defines which drugs are covered (and is free to exclude drugs from coverage), and also sets the reimbursement rates through an external reference pricing system. Prices for over-the-counter drugs and prescription drugs not covered by insurance are unregulated.

- United States (Tier 2): The U.S. has a hybrid system, in which the vast majority of the elderly, the disabled, veterans, and active-duty military are enrolled in single-payer health insurance through Medicare, the Veterans Health Administration, and the Department of Defense. In addition, U.S. residents near or below the poverty line are enrolled in single-payer coverage through Medicaid and the Children’s Health Insurance Program. Together, these categories represent more than one-third of the U.S. population. Approximately two-thirds are enrolled in private coverage, usually subsidized, either through employer-sponsored insurance (50%), individual market coverage regulated by the Affordable Care Act (7%), and private plans administered through Medicare Advantage (6%). Drug prices are unregulated in the private market, but reimbursed according to a variety of formulas in the public programs. The VHA and DOD directly negotiate drug prices.

Applying international benchmarks to the privately insured market

In March 2019, Florida Sen. Rick Scott introduced a bill, the Transparent Drug Pricing Act of 2019, which included a provision mandating that “the retail list price” for an FDA-approved drug in the U.S. “may not exceed the lowest retail list price for the drug among Canada, France, the United Kingdom, Japan, or Germany.”

While Sen. Scott’s interest in lowering drug prices is laudable, it is different in character from the Trump admninistration’s proposal to improve the market orientation of Medicare Part B. The Scott bill would apply to all drugs sold in the U.S., and to drugs subsidized both by private and public insurers.

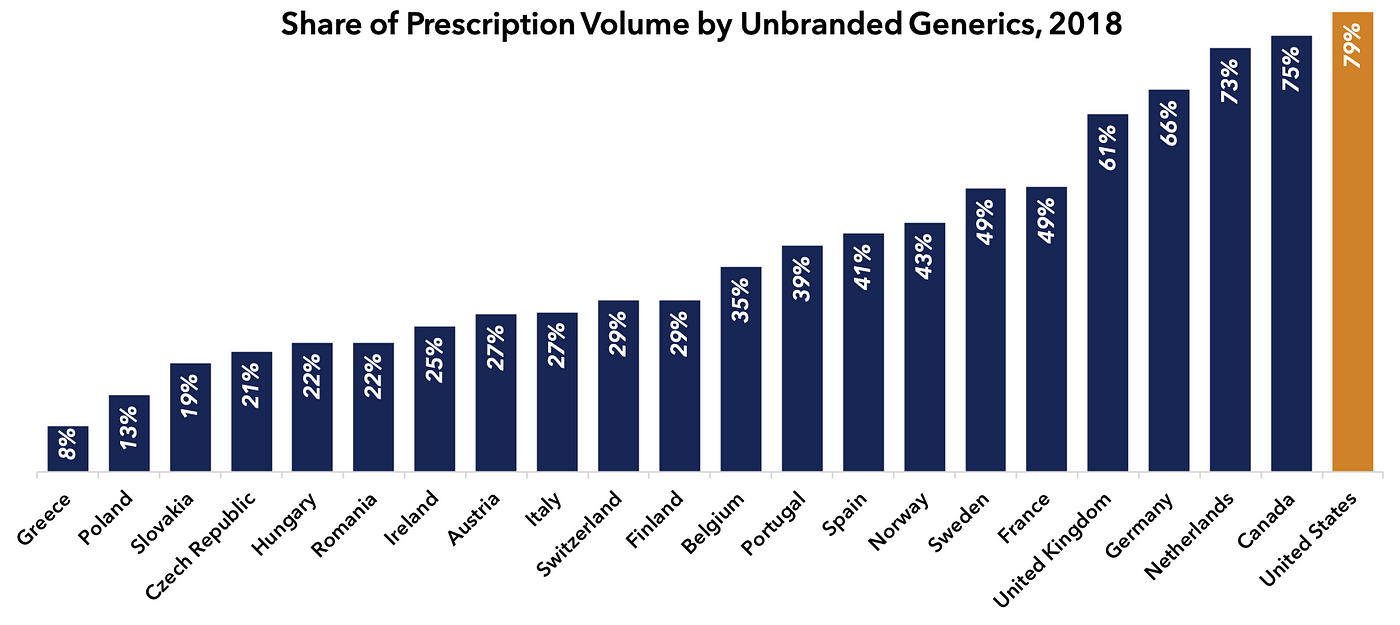

Like the Trump IPI concept, the Scott proposal does not discriminate between market-based and single-payer countries in terms of constructing its benchmark. Furthermore, it fails to appreciate that the U.S. market-based system is superior to those of our industrialized peers in terms of encouraging the use of inexpensive generic drugs, where applicable. Indeed, for the 90 percent of U.S. prescriptions which deploy generic medicines (79 percent unbranded generics, 11 percent branded generics), U.S. prices are generally lower than those of peer nations.

An international benchmark like the Market-Based International Index could be useful in situations where manufacturers are exploiting artificial monopoly power to extract higher prices in the U.S. than we would see in a true market. These situations include:

- Biologic drugs whose composition of matter parents have expired. For a host of reasons, the market for off-patent biologic medicines in the U.S. is broken, leading to monopoly pricing long after the branded drug’s core patent has expired. The MBII could be applied to such situations as way to mitigate this problem.

- Biologic drugs with no intellectual property. The Affordable Care Act grants 12 years of market exclusivity to any biologic drug that gains FDA approval, regardless of whether or not it has any actual patents to its name. Drugs relying on this artificial monopoly should be subject to an international benchmark like MBII.

- Orphan drugs that treat rare diseases. The Orphan Drug Act creates artificial 7-year monopolies for drugs that treat diseases whose prevalence in the United States is fewer than 250,000 individuals. Drugs for rare diseases usually face no competition, due to their smaller markets. This legal and economic structure has led to exploitative pricing practices, which could be mitigated by the application of the MBII, as soon as feasible after the launch of a given drug.

- Customized therapies such as CAR-T. A new generation of customized therapies use genetically modified viruses and other gene-editing techniques to alter the machinery of a patient’s cells. For these treatments, the conventional system of off-patent genericization will not apply. The MBII could help mitigate this problem.

Opportunities for further research

There remain outstanding technical questions about an international benchmark for the way Medicare Part B pays for physician-administered drugs. For example, list prices do not necessarily reflect discounts or rebates to wholesalers and insurers, and so the Centers for Medicare and Medicaid Services will need to determine methods of standardizing its benchmarking data, possibly by requiring disclosure of net or invoice pricing from manufacturers across countries.

Also, it is an open question as to whether the prices in the MBII should be further weighted by national prescription volume, or equally weighted by country. For example, in Tier 2, a volume-weighted approach would heavily rely on prices in Japan, Germany and France, where pharmaceutical prices are relatively high.

Regardless, it is a useful and worthy exercise to learn from pharmaceutical markets outside the United States. Countries like Denmark and Singapore use simple tools, like reference pricing and reimbursement lists, to achieve competitive pharmaceutical prices without price controls.

While we have not calculated the quantitative difference between prices in the IPI and the MBII, we believe that they will be similar. Indeed, it is possible that MBII-based prices would be lower. But the MBII would do a better job of aligning Medicare with countries that support pharmaceutical innovation, and could serve as an impetus for Medicare to learn from how other market-oriented countries improve the affordability of innovative medicines.

Most importantly, market-based reforms for the purchase of prescription drugs would actually make innovative medicines more affordable for those who most need them, and help make Medicare more fiscally sustainable for those who depend on it.